What Is My Background Check Cival Rights When Applying To Lease A Condo

This is role 8 of our Landlord'south guide to Tenant Screening. If y'all've landed here direct don't worry — we cover everything you need to know well-nigh rental groundwork checks below.

A rental background check is like an 10-ray that allows yous to see beneath the surface of a potential tenant.

This epitome might ring a bell for cornball Simpsons fans.

Maybe you recollect the time Homer went to the doctors for an x-ray.

The purpose of the rental groundwork check is to see any issues that might be hiding beneath the surface.

It's a simple way to identify blood-red flags and avoid problematic tenants.

In this postal service, nosotros will answer the question, "What does a rental background cheque consist of?"

For the purpose of simplicity,we will use one of our SmartMove reports equally an example for reference in this post.

But before we go alee of ourselves…. allow'south start with…

What Is A Rental Background Check?

A rental background check is an boosted screening tool that allows landlords to come across various aspects of a tenant applicant's past behavior.

The majority of the data yous'll see comes from the 3 major credit bureaus:

- TransUnion

- Equifax

- Experian

This information helps to paint a moving picture of how responsible a tenant might be.

Some landlords wait at the overall credit score while others pay specific attention to the details of the report.

Where Exercise Credit Bureaus Get Their Information?

"These 3 credit bureaus collect data from your creditors, such every bit a banking company, credit card issuer, or automobile finance company. They also become information about y'all from public records, such as property or court records. Each credit bureau gets its information from different sources so the information in one credit bureau's study may not be the same as the information in some other credit bureau's report." – Source FederalReserve

What Does A Rental Background Check Consist Of?

Here is what 1 of our SmartMove rental groundwork checks consists of:

- Personal Details – provided by the applicant (pba)

- Address (pba)

- Income (pba)

- Total Credit Score (called ResidentScore by TransUnion)

- Address History

- Employment History

- Tradelines

- Collections

- Consumer Statements

- Inquiries

- Public Records

- Eviction Records

- Criminal Records

- AKAs

Nosotros volition at present encompass each topic in more than detail. Y'all can click whatsoever of the items in a higher place to be pulled down the page to learn more.

Personal Details

The tenant applicant enters this information. All of this information is required except the center proper noun.

Read this if the applicant does not accept a social security number or is unwilling to provide it.

The personal details provided in this box are important considering in that location are only three main identifiers for any person:

- Name

- Engagement of Birth

- Social Security Number

With over 325 million U.S. residents information technology's best to get all 3 identifiers.

Stephen White is the proper name of our CEO here at RentPrep and the terminal fourth dimension we checked there were over 2,600 matching names in the U.S. database.

This means it is nonetheless possible to take two Stephen White's with the same exact date of birth.

Tenant's Current Accost

This is too provided by the tenant and is of import information. This current accost should match the information provided on the rental application.

It'south a good thought to get understanding of the applicant's current living situation.

Do not assume that they're currently renting as they might own their current habitation and are going through a divorce or perhaps they live with family currently.

A simple pre-screening question such as "Do yous currently rent, and if so, where?" should assist you better understand their current state of affairs. It's a good idea to keep notes throughout the tenant screening procedure so you tin can reference back to them later.

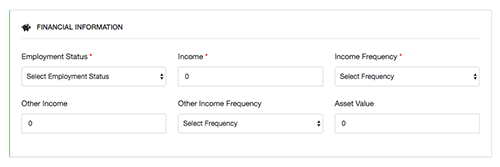

Tenant Applicant's Income

With our SmartMove reports, the tenant applicant volition write in their income.

At this point, the applicant should be well aware of your rent to income ratio.

Your minimum income requirements should be laid out in your tenant screening criteria.

You lot'll desire to check the post-obit:

- Does the income listed on the rental background check match what they listed on their rental application?

- Practise they run into your minimum income standard?

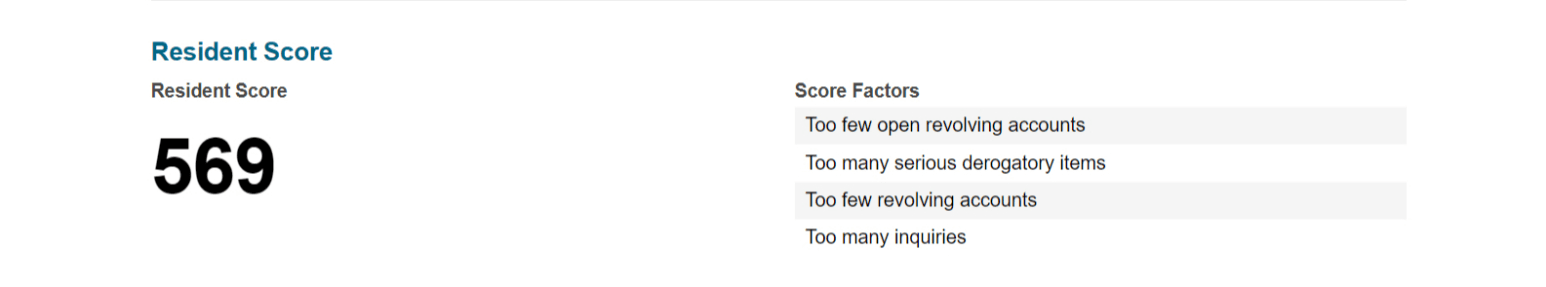

Tenant Applicant'south Resident Score

The rental groundwork check through our SmartMove report supplies a TransUnion Resident Score ranging from 350 – 850.

A proficient TransUnion Resident Score that y'all can have confidence in ranges from 538 to 850.

Here is a expect at scoring ranges to consider when screening a tenant:

Reject: 350 – 523

Conditional: 524-537

Low Accept: 538-559

Accept: 560- 850

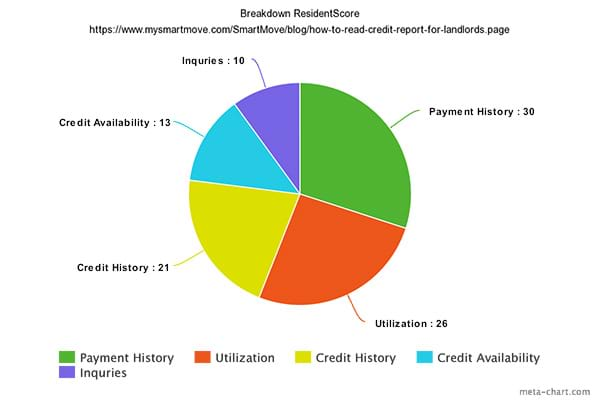

The score itself is determined past several factors that we will break downwardly in the paradigm below.

A credit score is a compilation of many factors. TransUnion has created its own ResidentScore that is tailored to the rental industry.

This is done by giving more weight to payment history as this data is more important to a landlord.

There is usually a discrepancy betwixt the credit bureaus and what they study for a credit score. Each bureau uses a unlike FICO model to assess credit.

This breakdown is specific to the TransUnion ResidentScore used with SmartMove. If your applicant runs their ain credit through a different service, the numbers may differ.

For instance, Credit Karma uses a VantageScore model where TransUnion SmartMove is based on a FICO model.

The FICO model is a much improve model (in our opinion) because that it was the big bulk of banks use when they assess credit for a mortgage.

Credit Karma knows that their client wants to see a ameliorate score. If they featured lower credit scores using the classic 2004 FICO model they wouldn't retain equally many users.

Address History

Large databases are cultivating information on us all the time.

You signed up for a mag 10 years ago at one residence and had a cell phone plan billed to your last residence. In that location'due south a take chances that information was sold and eventually ended up in one of the databases that TransUnion pulls data from.

This is how a groundwork bank check is able to pull upward previous address history. Keep in listen these addresses are non verified and practice non necessarily mean they were renting.

The applicant could have been living with family in ane of those known addresses.

Compare the accost history to what was included in your rental application. You'll want to call and verify with the current and previous landlords that the applicant was a tenant.

Skillful rental history is a sign of a stable renter. If you have someone with no rental history, yous're taking on more than risk with an unknown commodity. In these instances (usually young or student rentals) many landlords will crave a co-signer and/or increased security deposit.

Employment History

Similar to the address history the employment history records are cultivated from large databases.

These records are not verified, so information technology's important that you call the current employer to verify information.

In the video to a higher place our CEO, Steve White, walks y'all through how to do an employment verification phone call.

Tradelines

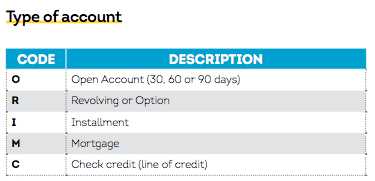

Merchandise Lines (or tradelines) are accounts on a background check or credit study.

This prototype shows the trade lines associated with our SmartMove reports.

The about common accounts for renters are revolving (credit cards) or installment accounts (anything with a fixed payment plan such equally an automobile loan or educatee loan).

You lot tin can learn more about trade lines from our knowledge base of operations article.

Collections

When a renter has a trade line that doesn't get paid the business relationship tin can be sent to collections.

The about common accounts are local utilities, credit cards, medical debts, and cell phones.

This is a red flag considering nigh services practice not get immediately to collection upon payment existence belatedly.

Creditors typically send an account to collections afterward half dozen months of not-payment, simply this fourth dimension frame varies depending on account type.

A i-time late payment can exist considered a mistake, but a collection on your report shows a pattern of non-payment.

Some collections tin garner wages. This can only happen if the creditor takes the consumer to court and is awarded a judgment.

If you accept a renter with garnished wages, it ways those funds are removed from their pay before they even meet their paycheck.

Consumer Argument

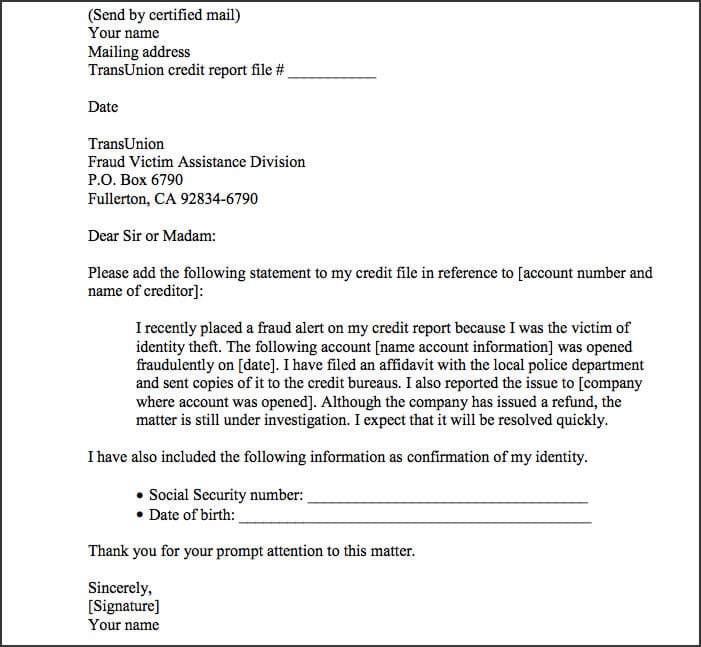

A consumer (or your example a tenant applicant) has the opportunity to upshot a consumer statement on their report.

The to a higher place image comes courtesy of creditcards.com and is a sample of what a consumer statement looks like. In this case a consumer argument to TransUnion pertaining to identity theft.

This is a concise argument of 100 words or less that gives the consumer an opportunity to explain things in their report.

There are ii kinds of statements (co-ordinate to Experian) that a tenant can request to be added to their credit written report.

- An account-specific dispute

- General statement

The business relationship-specific dispute is linked directly to the account in question. If that account is removed from the report, the statement is removed at the same time.

The general statement lasts upwardly to 2 years on a credit study and is not deleted when a specific account is removed from a report.

This could be helpful in explaining if their credit was negatively impacted due to fraud, medical debt, or an fault or dispute with a business.

Inquiries

In this section of the background report, yous'll see any inquiries on the applicant'southward record.

Credit inquiries are requests by a "legitimate business" to check your credit. If your applicant applied for an auto loan with a bank, the bank would check their credit creating an inquiry.

Credit inquiries are classified equally either "hard inquiries" or "soft inquiries," and simply difficult inquiries have an event on a FICO score (source MyFico).

Our SmartMove reports & credit check reports are a soft pull on credit.

Let's say your applicant recently applied for multiple educatee loans, multiple auto loans, and multiple credit cards.

The student and auto loans would each be treated as 1 research. That's because information technology is considered normal to shop around for these.

Yet, each credit carte du jour research volition exist recorded as a separate inquiry. This is because someone might be considered a college credit risk if they're trying to open multiple lines of credit in a short amount of time (source MyFico).

Public Records

Public records consist of the following:

- Bankruptcies

- Civil Judgments

- Tax Liens

There are ii types of bankruptcies.

Affiliate seven – These remain on a credit report for 10 years from the filing date considering in that location was no repayment

Affiliate thirteen – These are deleted seven years from the filing date because there was partial or full repayment

This is why some landlords will make concessions for a Affiliate 13 bankruptcy (such as an increased security deposit) but will not have an applicant with a Chapter seven on record.

If your applicant has a civil judgment this means they were sued and lost and owed a debt by the court. These remain for 7 years on a report.

Taxation liens occur when a tenant bidder has not paid their taxes. Unpaid tax liens remain for xv years where paid tax liens remain for 7 years from the paid date.

Information will brandish aslope the public record if information technology is paid, discharged or settled (source – Experian).

As of July 1st 2017, the large majority of judgments and liens are removed from credit reports.

Due to these changes, it's estimated that 96% of civil judgments and fifty% of tax liens have been removed from credit reports. Bankruptcies were not afflicted (source).

This is if yous're running a credit report. Our Basic, Pro and Platinum reports include a separate search exterior of a standard credit report that allows us to access this data.

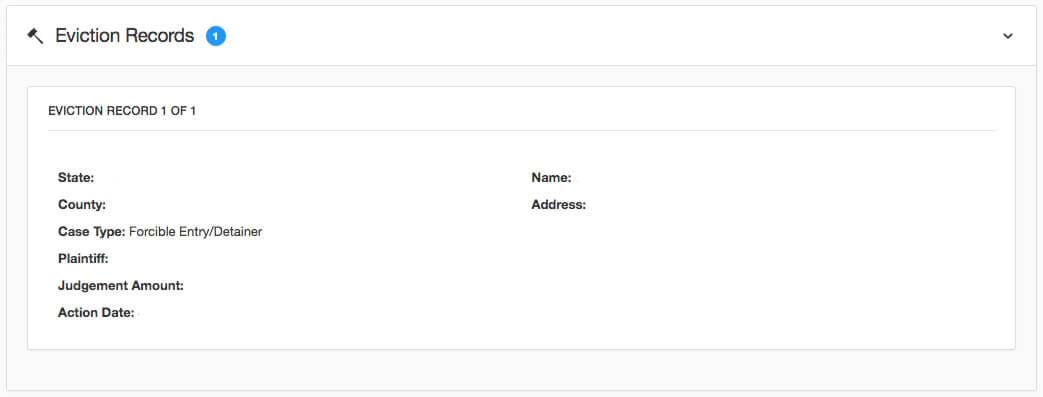

Eviction Records

The epitome above shows a template of what is provided on an eviction record in ane of our reports.

Here'due south a quick rundown of each item.

- Country – The state where the eviction took place

- Country – The county where the eviction took identify

- Example Type – Forcible Entry/Detainer is the legal wording for an eviction

- Plaintiff – Typically the landlord, flat complex or property manager

- Judgment Amount – If left blank at that place could exist no judgment amount just if rent is owed this could terminate up here

- Action Date: The date the eviction was candy in court

- Name – The person's name that was evicted

- Address – The address they were evicted from

Previous rental history is a adept indicator of how a renter will exist in the future.

That is why eviction history is one of the most telling items on a background written report.

TransUnion did a study where they analyzed records from well-nigh 200 properties comparing tenants who were evicted to those who were not evicted.

Applicant A volition represent the tenants who were evicted while Applicant B represents those who were non evicted.

They found that 21.vii% of the evicted tenants had a prior eviction on record whereas only 5.five% of the non-evicted group B had a previous eviction.

What does this data mean?

It means that if your tenant applicant has an eviction on record, they're much more likely to be evicted again.

Going through a 2nd eviction is like the second time through a haunted house.

The fear of the unknown has been removed, and this is why yous should exist scared of someone who has an eviction on tape.

They're not going to be scared to become through another eviction.

Criminal Records

![]()

The ways criminal records are to exist considered is changing in many areas. It'southward important to check your local laws to make sure there aren't additional considerations placed in your area.

We covered this in item on the tenant screening criteria page in that you should no longer use a blanket criminal policy with your rentals.

All the same, criminal records are permissible screening tools if you tin create a nexus (fancy word for connection) betwixt a criminal tape and why someone wouldn't exist a good renter.

When you order a rental background bank check the information gathered from criminal records comes from courts all over the country.

With our SmartMove reports, there are over 200 one thousand thousand records searched at the Country and Federal level.

A background cheque will get together all bachelor criminal data that is reportable.

A criminal tape is reportable for upwards to seven years under the rules of the FCRA.

A criminal conviction is reportable indefinitely.

Departure Between An Arrest And Confidence?

Arrested – This states you were taken into custody only doesn't necessarily mean y'all were convicted.

Charged – This is the next step where the prosecutor's function will brand a determination whether to charge you. This states criminal charges y'all are facing.

Bedevilled – The person has been proven or declared guilty of the offense.

Sentenced – This is when a formal judgment is issued that spells out the penalty.

Why Does The Blazon Of Criminal Tape Affair?

HUD spells it out clearly that y'all should not deny an bidder based solely on an arrest without confidence.

"A housing provider who denies housing to persons on the basis of arrests not resulting in a confidence cannot prove that the exclusion really assists in protecting the resident safe and/or holding."

This 10 page HUD document boils downwards to two paragraphs in the conclusion.

"Policies that exclude persons based on criminal history must exist tailored to serve the housing provider's substantial, legitimate, nondiscriminatory interest andtake into consideration such factors as the type of the crime and the length of the time since confidence. Where a policy or practice excludes individuals with simply certain types of convictions, a housing provider will notwithstanding bear the brunt of proving that whatever discriminatory issue caused by such policy or do is justified. Such a determination must be fabricated on a case-past-case footing."

Basically, if you're going to employ a criminal record in your screening you must make a feasible case for why that crime jeopardizes the resident safety and/or property.

AKAs

AKAs stands for "as well known as" a maiden name is the most common example of an AKA.

If your applicant's name is "Michael Smith" an AKA tin can be listed equally "Mike Smith."

In the criminal sense, if the person committed a crime under a known alias (or pseudonym), that alias would show up under this section.

Some people have a known allonym that acts as a nickname while others have gone through the legal steps to change their name.

Here'south a listing of famous athletes that would near likely have an AKA testify up on their background check.

- Babe Ruth (George Herman Ruth, Jr.)

- Bubba Watson (Gerry Lester Watson, Jr.)

- Chad Ochocinco (Chad Javon Johnson)

- Dabo Swinney (William Christopher Swinney)

- Karim Abdul-Jabbar (Sharmon Shah)

- Spud Webb (Anthony Jerome Webb)

What Is My Background Check Cival Rights When Applying To Lease A Condo,

Source: https://rentprep.com/tenant-screening/rental-background-check/

Posted by: donaldsonmucland.blogspot.com

0 Response to "What Is My Background Check Cival Rights When Applying To Lease A Condo"

Post a Comment